In the ever-complex domain of payment processing, entrepreneurs and business owners frequently grapple with a confusing array of pricing models. Two standout frameworks that often rise to the surface are Interchange++ and Blended Pricing. Aimed at decoding the intricacies of these fee structures, this in-depth guide spotlights the virtues and drawbacks of each model, along with their impact on your business’s financial health.

The Transparency of Interchange++ Pricing in Payment Processing: A Deep Dive

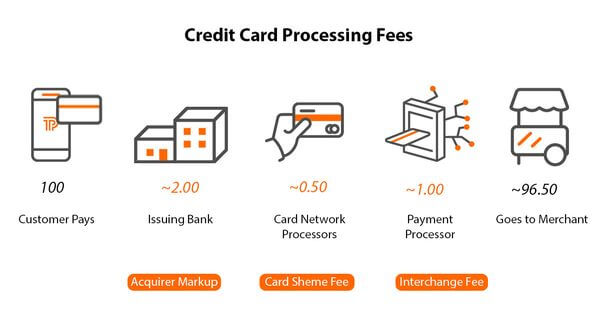

Interchange++ pricing is lauded for its granular, transparent fee structure, offering a meticulous breakdown of the expenses linked with every transaction. This model segments costs into three critical elements:

- Interchange Fee: Dictated by renowned card networks such as Visa and MasterCard, these fees are transferred to the issuing bank as a part of the transaction process. Variables like card type (credit or debit), brand loyalty, transaction characteristics, and industry-specific factors can sway these costs.

- Card Scheme Fee: These are additional costs imposed by card networks, allocated for maintaining and operating the transaction infrastructure.

- Acquirer Markup: This is where the payment processor gets its share. A markup is added to the interchange and card scheme fees, constituting the payment processor’s primary revenue stream.

The beauty of the Interchange++ model is its transparent nature. Businesses directly pay the raw interchange and card scheme fees to the card networks, in addition to a clearly itemized markup from their payment processor. This unparalleled transparency gives merchants a thorough understanding of the individual cost elements and the processor’s profit margins.

The All-Inclusive Nature of Blended Pricing in Payment Processing

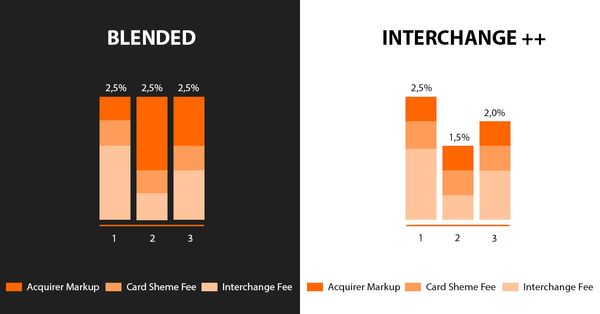

In contrast, Blended Pricing is designed for business operators who favor simplicity over granular fee analysis. This model unifies all transaction-related expenses into a single, aggregated rate.

- Bundled Rate: The payment processor offers a one-size-fits-all rate that encompasses all associated costs—namely, interchange fees, card scheme fees, and the processor’s own markup.

The Key Differentiators: Interchange++ vs Blended Pricing

The salient distinction between Interchange++ and Blended Pricing rests on two pillars—transparency and cost control. The Interchange++ model excels in providing a granular view of the fee architecture, allowing businesses to decipher exactly where their expenditures lie. Conversely, Blended Pricing simplifies the cost equation, presenting you with a single, consolidated rate. While it offers the benefit of simplicity, it compromises on the visibility of individual fee components.

Final Thoughts

Understanding the nuances of these payment processing models is imperative for businesses striving to make well-informed decisions. Each model aligns with distinct operational and financial goals, necessitating a careful assessment to determine the best fit for your business.