A Payment Service Provider or PSP can be described as a third-party payment provider that will assist merchants and businesses to handle payments. The PSP is the intermediate that will connect the merchant with payment solutions.

In other words, the PSP will make it possible for the business to accept and process payments from credit cards and other electronic payment methods. In most cases, the Payment Service Provider will provide the business with a payment gateway.

As a payment solution distributor, you need to recommend Payment Service Providers that will make it possible for merchants to manage all payments in a safe, efficient and easy way.

Why do merchants need PSPs?

Besides making it possible for merchants to accept payments, the Payment Service Provider may also take care of the whole payment process. That way, merchants will be able to focus on their business instead of worrying about payments.

In addition to this, PSPs will often offer extra services. These will often contribute to an even better payment experience for businesses and their customers.

Let’s take a look at some of the services a PSP may include.

Improved security

In many cases, Payment Service Providers will give merchants access to high security solutions. In general, PSP payments will have high security standards to make payments safe and secure for both customers and merchants alike.

A PCI-DSS certificate will ensure that sensitive payment data is secured, and is one of the most common security measures among PSPs.

Contactless payments

PSPs may also make it possible for merchants to accept contactless payments. Today’s customers will not necessarily pay with traditional magnetic stripe cards. Contactless solutions like Vipps and Apple Pay are getting increasingly popular.

With a smart mobile point of sale (mPOS) system, your business customers can receive contactless payments through their PSP.

Omnichannel payments

Omnichannel POS systems are making it possible for merchants to receive payments through different channels. Some customers might prefer to pay in-store, while others prefer online payments.

For instance, a merchant that is selling shoes in-store and online should be able to receive payments through both channels.

Tidypay is a Payment Service Provider that will make omnichannel payments possible for your business customers. By combining a Tidypay Gateway based on a SUNMI device and the Tidypay eCom system, the merchant may receive payments both in-store and online.

Easier bookkeeping and reporting

For most merchants, reporting and bookkeeping is considered to be both time consuming and intricate work. Luckily, some Payment Service Providers will make the process easier by including smart reporting features.

Systems like Tidypay One can be integrated towards the merchants accounting system. With automatic postings of payments and other smart features, the merchant can spend less time on time consuming bookkeeping tasks.

Cross-border payments and several currencies

For businesses that sell their products and/or services across borders, it is crucial to be able to process different currencies. Luckily, many Payment Service Providers facilitate international payments as they accept several currency types.

With Tidypay One for instance, merchants will be able to choose between ten different currencies.

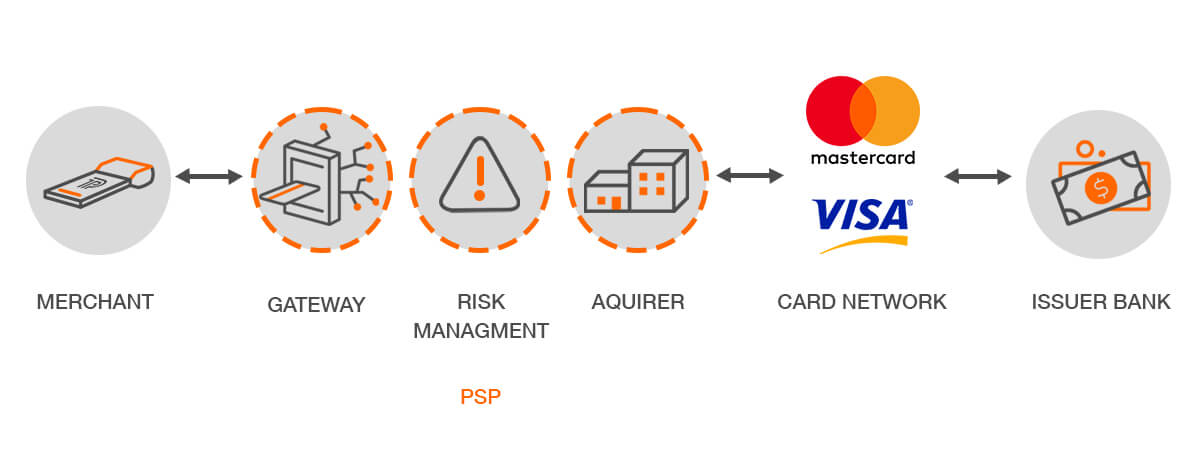

How does a PSP work?

A Payment Service Provider will cooperate with the payment processors (banks) to make sure the payment is processed correctly from start to finish. In most cases, the process will look something like this:

- A customer completes a payment through the merchant’s POS

- The payment details will be delivered electronically to the relevant bank

- The transaction details are then sent to the payment network belonging to the credit card

- Payment details will be transferred to the issuing bank

- The payment might be accepted or declined, and the result is sent to the payment network

- The information is then sent back to the bank, which will send the result to the PSP

- The PSP will tell the merchant and customer whether the payment was accepted or not

- If the payment is accepted and authorized, the funds will be sent to the acquiring bank through the payment network, and then deposited to the merchant account provided by the PSP

Learn more about our Tidypay PSP

If you are looking for a user-friendly and secure Payment Service Provider to recommend to your customers, Tidypay is one of your best choices.

Our PSP systems are PCI-DSS-certified and secure, omnichannel-friendly and will provide your customers with smart features like automatic reporting.